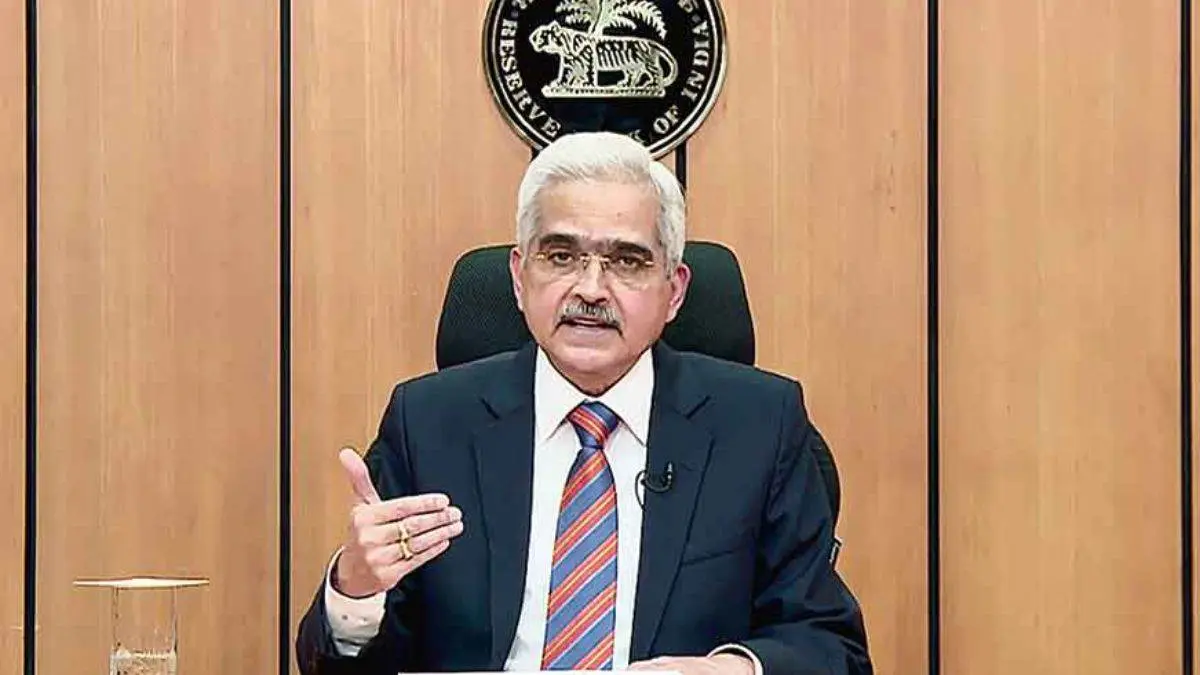

RBI Monetary Policy Highlights: This is the third consecutive meeting in which the MPC has decided to maintain status quo on the repo rate. The MPC had last increased this rate from 6.25 percent to 6.50 percent in its meeting in February. RBI Governor Shaktikanta Das said India’s GDP is likely to grow by 6.5% in FY 2024. RBI has pegged inflation at 5.4% for FY24. The RBI Governor has said that the Indian economy is a bright spot in the global economy. RBI will allow offline payments using UPI using near-field communication. The central bank has increased the payment limit through UPI Lite from Rs 200 to Rs 500. RBI says home loan, other borrowers can switch to fixed rate regime.

RBI MPC Meeting Live, Repo Rate News News: RBI Monetary Policy Committee has kept the key policy repo rate unchanged at 6.5. Last time in February, MPC had increased this cost from 6.25 percent to 6.50 percent in its guest room. RBI Governor Shaktikanta Das has said that India’s GDP is likely to grow by 6.5% in the financial year 2024. RBI has pegged inflation at 5.4% for FY24. Shaktikanta Das said that Indian finance is a golden place. UPI will allow offline payments RBI aims to use near-field communication

✔https://nayasaveraa.com/bajaj-pulsar-ns-200-mileage-features-top-speed

RBI has kept the repo rate unchanged at 6.5%. Apart from the repo rate, the RBI Governor has made comments related to the central bank’s GDP forecast, outlook, liquidity, macro economy, etc. Here is its list.

Highlights of RBI’s monetary policy

- The Reserve Bank of India (RBI) has maintained it at 6.5 percent. This is the third meeting regarding the key policy repo rate in which the MPC has decided to maintain status quo on the repo rate.

- The RBI has said that the focus will be on taking a mutual strategic approach to ensure that growth remains aligned with the target while supporting growth.

- It has retained the GDP growth projection for FY 2024 at 6.5 percent

- RBI has slightly revised the average growth estimate to 5.4 percent. Vegetable prices on the rise due to central bank’s favorable tomato stance may put major pressure on inflation trajectory in the near term

- RBI to take steps to insure greater transparency in interest rate reset of EMI-based benchmark loans. Borrowers will get options to switch to a fixed rate loan or foreclose the loan Borrowers will get options to switch to a fixed rate loan or foreclose the loan

- The Reserve Bank is planning to bring artificial intelligence (AI) in UPI payments. Near Field Communication (NFC) technology will be deployed in offline payments through UPI-Lite

- RBI proposes to increase transaction limit for small value digital payments in UPI Lite from ₹200 to ₹500

- To absorb the surplus situation in the banking system arising out of various factors including withdrawal of ₹2000 notes, RBI asked banks to gradually increase the cash reserve ratio (ICRR) of 10 per cent on the increase in their rupee deposits between May 19 and July 28. ) is said to be maintained. ,

- RBI Governor Shaktikanta Das has announced that the cash reserve ratio (CRR) will remain unchanged at 4.5 percent.

- Current account deficit to remain largely manageable during FY24, as per RBI estimates

- The next meeting of the RBI rate setting committee (MPC) will be held on October 4-6.

RBI Policy Live Updates: Public lending platform to be launched by RBI for frictionless disbursement, says RBI Governor.

RBI Governor says based on pilot learning, public lending platform for frictionless disbursement will be launched by RBIH. RBI launches pilot KCC loan with RBIIH. Now it has become operational in selected districts.

यह भी पढ़ें

- Vivo T3x 5G (क्रिमसन ब्लिस) एक लोकप्रिय स्मार्टफोन है जिसे आप ऑनलाइन और ऑफलाइन दोनों जगहों पर आसानी से खरीद सकते हैं।

- Rafael Nadal boosts Olympic 2024 chances by winning four-hour battle with Navon

- Bad News Vicky Kaushal and Tripti Dimri’s film Day 1: Collection has earned ₹ 9 crores, has received very good reviews.

- Microsoft cloud service 2024 to disrupt air travel operations

- NEET PG 2024 exam city list released on natboard.edu.in

FAQS: RBI Monetary Policy Highlights

✔What is the next monetary policy of RBI in 2023?

Ans: The RBI’s MPC has kept the repo rate at 6.5% for a fourth meeting, despite rising inflation. This was the fourth consecutive meeting in which the MPC kept the rate unchanged.

✔ What is the RBI MPC meeting August 2023?

Ans: Business owner perspective: “RBI’s decision to keep the basic rate unchanged is good news for businesses, as it will help to keep borrowing costs low.”

✔ How many times monetary policy is announced in a year?

Ans: The Monetary Policy Committee (MPC) was established by the Reserve Bank of India Act, 1934 to enhance transparency and accountability in India’s monetary policy setting. The MPC meets at least four times a year, and its monetary policy decisions are published after each meeting, with each member explaining their views.

✔ What is expected date for RBI Assistant 2023?

Ans: Make the sentence more engaging: Attention RBI Assistant aspirants! The exam dates have been revised. Preliminary test on November 18-19, main test on December 31. Start preparing now!